“Intelligence is the ability to adapt to change”

– Stephen Hawking

OUR PHILOSOPHY

Cantilever’s investment philosophy stems from a worldview of constant change and progress. Globalization has more than ever increased the connectivity of people, companies and governments, while the rate at which information is now transmitted has become instantaneous. World governments are trying to manage the new, global economy with policies which would have never been imagined in prior years.

In light of the changing global landscape, markets have responded with some of the worst recessions and most volatile stock market rallies in modern history and have proven that “what used to work” is no longer adequate for successful investing. The financial services industry and investors are left with a choice – adapt or fail. At Cantilever, with our disciplined approach, we choose to adapt.

“All religions, arts, and sciences are branches of the same tree”

– Albert Einstein

OUR Multi-Faceted Process

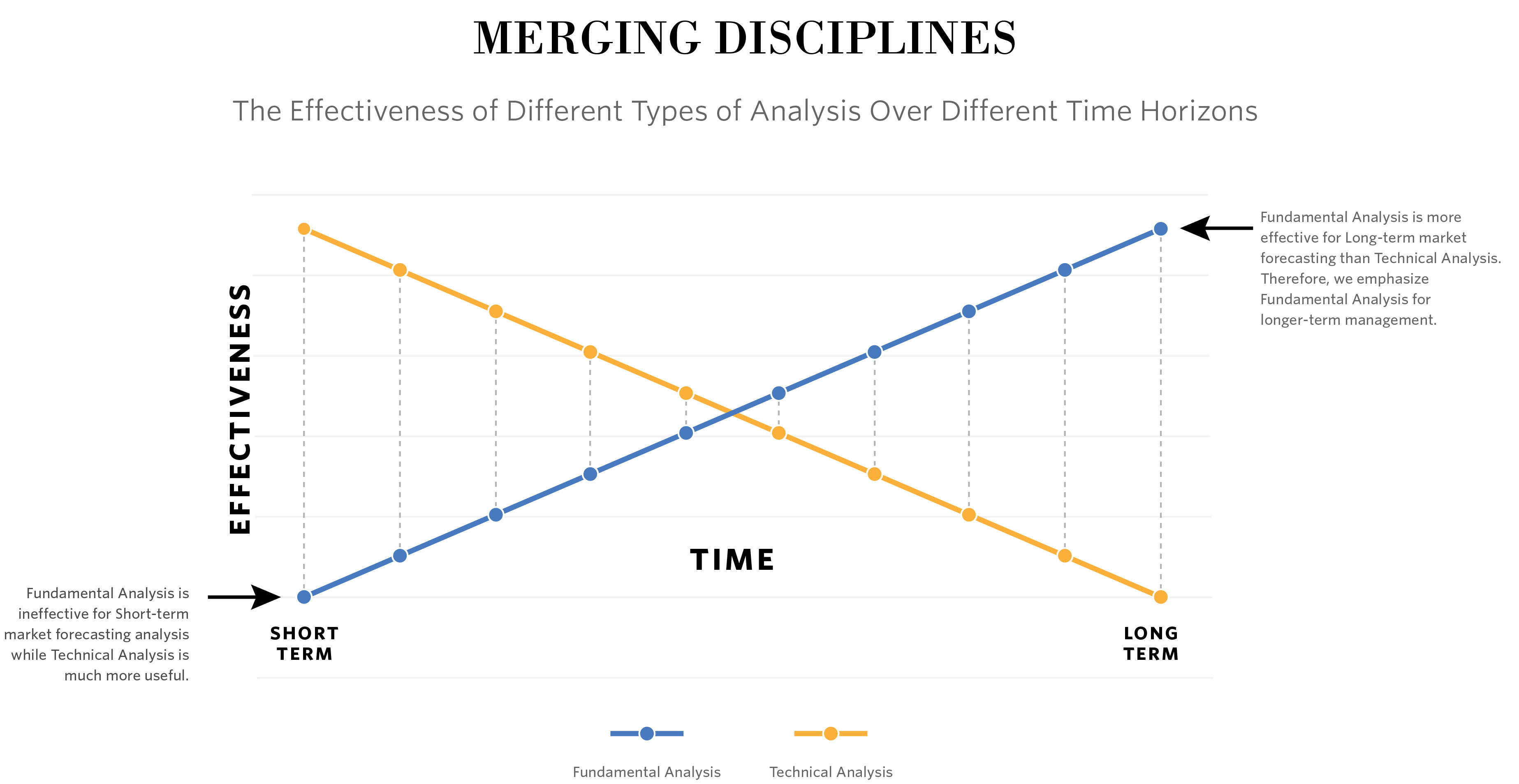

Like any discipline, there are multiple areas of study in the field of finance. Fundamental and economic analysis uses data to gauge the prospects of global economies and businesses and is useful for finding long-term investment opportunities. Behavioral and technical analysis measures the relationship between supply and demand and helps determine if markets are at extremes and is useful for avoiding major stock market declines, such as those that occurred from years 2000 through 2002 and 2007 through 2009. Quantitative analysis helps provide feedback to further hone our investment processes to better adapt to a changing marketplace.

Most investment managers will choose to emphasize one field of study while ignoring the others, leaving significant gaps in the investment process. A fundamental-only investor may buy the stock of a good company in a poorly performing market. A technical investor may get too caught up in short-term stock price movements and lose sight of long-term financial goals. A quantitative manager may create a robust investing program, but forget that a system which was successful in the past may not work in the future. We reconcile the strengths and weaknesses of each of these types of analyses, incorporating one to make up for shortcomings of another. This multi-faceted approach closes the performance gaps impacting your investments.

Navigating Short Term Obstacles On a Long Term Journey

One of the greatest advantages of our approach is that it addresses both longer-term and shorter-term risks simultaneously. Fundamental analysis and strategic asset allocation aligns a portfolio with long-term goals. Investing with these methods only, however, turns a blind eye to what may happen to a portfolio over the near term – which we define as a period under two years. As we know, markets can move significantly over a two-year period, as they did from June 2007 to June 2009, when the S&P 500 Index fell by 39%. To mitigate these risks, we incorporate technical and quantitative analysis, which are more effective for shorter-term risk and portfolio management.