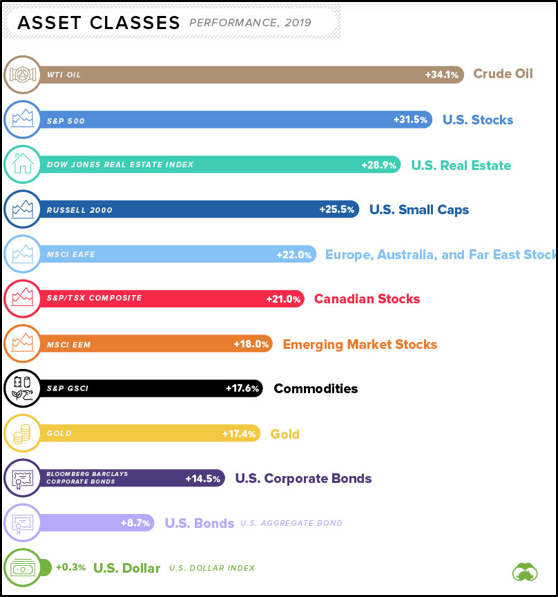

Blindfold yourself, grab a dart, and throw it at the Wall Street Journal. Whatever stock, bond, commodity, or fund you hit probably increased in 2020. Coming off a nearly 20% stock market drawdown at the end of 2018, 2019 was a year to make money.

Source: Visual Capitalist – All indexes assume dividends reinvested

Too Far, Too Fast?

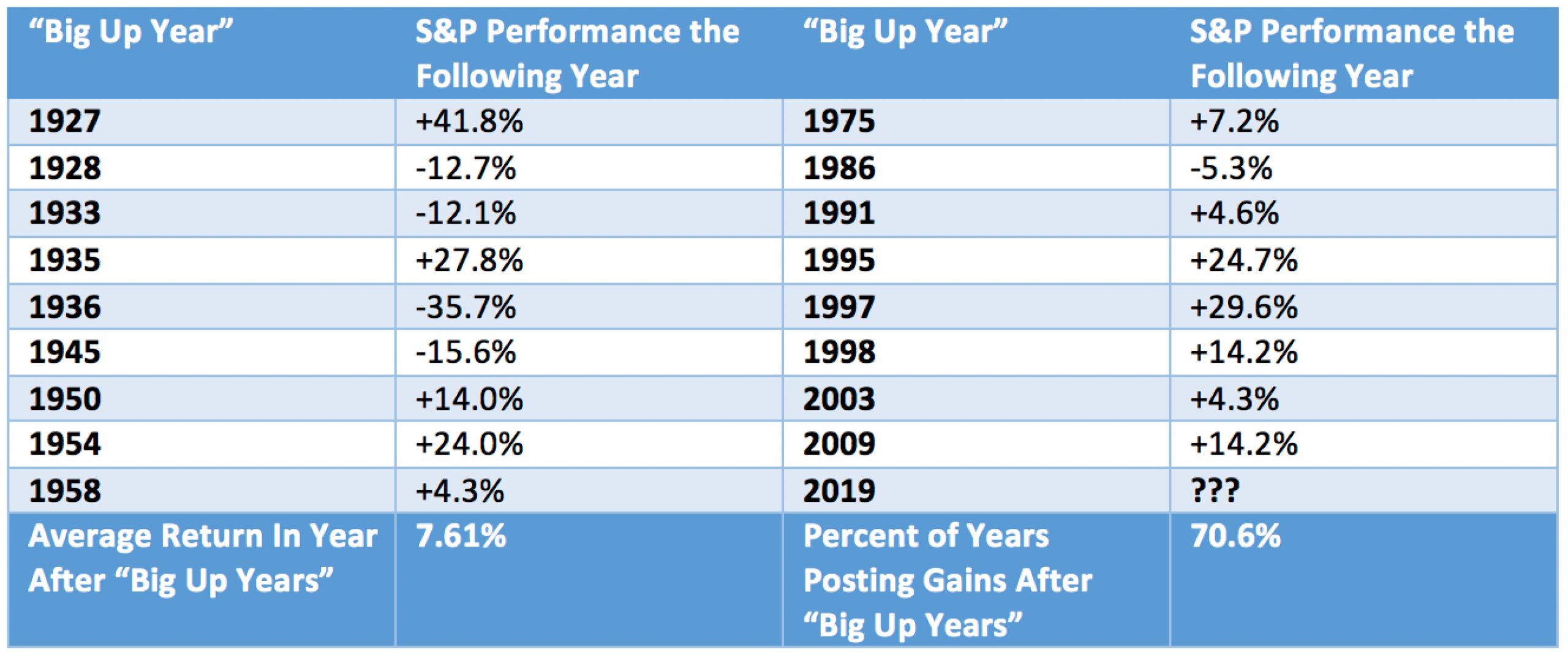

Big gains in the market lead investors to the conclusion that “if stocks climbed so much last year, then this year should be bad.” It seems to align with common sense, but market history suggests this line of thinking is incorrect. In fact, our research shows that the average return for the S&P 500 following a year with a gain of over 25% (“big up years”) is nearly identical to the average annual return for the S&P 500 over the last 100 years. Similarly, in the year after a big up year, the S&P finished higher 71% of the time – not much different from the percentage for all other years.

Source: Robert Shiller Database

Source: Robert Shiller Database

This line of thinking is counterintuitive, but history has indicated that a strong year in the stock market is not a predictor of poor performance in the following year. We attribute this to a behavioral concept called “herding.” When investors see other people making lots of money in the stock market, they develop a fear of missing out on further gains. So, they dogpile into stocks, pushing prices up even further. Various statistics on market sentiment confirm that investors are dogpiling into stocks right now. With this in mind, we expect strong performances from stocks over at least the near term.

Longer term, however, we are less enthusiastic and expect investment returns over the next ten years to be relatively low and in stark contrast to the persistently high returns we have observed over the past decade. More details below.

Explaining and Simplifying Our Longer-Term Forecasts – The Bond Riddle

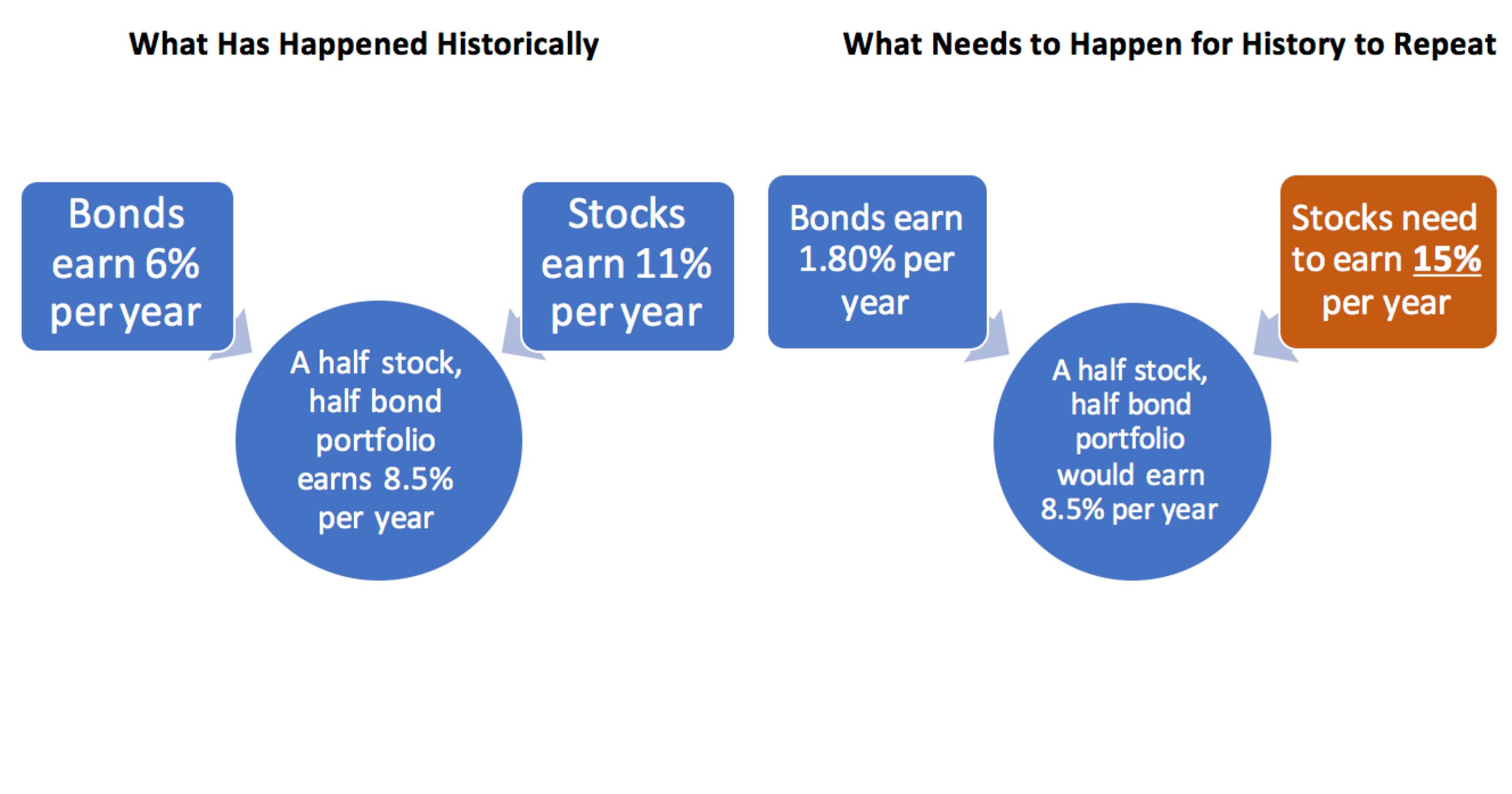

Here is a simple exercise that can help investors gain perspective of why investment returns should be low (relative to history) over the next ten years. Let’s create an imaginary portfolio of half bonds, half stocks. Historically, a diversified portfolio of stocks has returned around 11% per year, while a diversified bond portfolio has returned around 6%. Therefore, a portfolio of half stocks and half bonds has returned around 8.5% annually. Following so far?

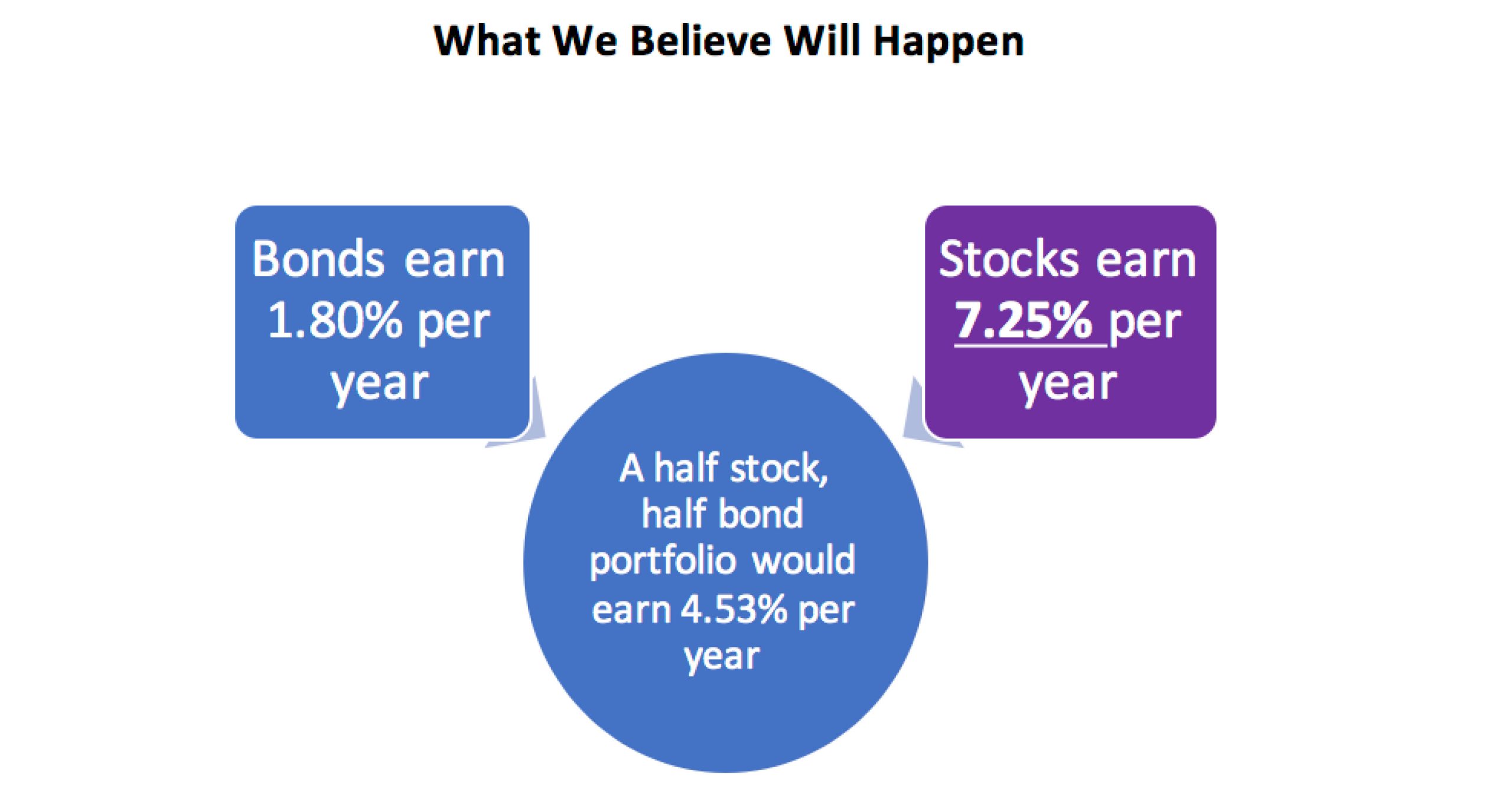

That’s the historical view – now let’s look forward. A 10-year Treasury bond is yielding about 1.80% as of January 22, 2019. That means if I buy a 10-year Treasury bond today, I’ll earn 1.80% per year until it matures in ten years. Okay, so what do I need to earn on my stocks each year in my half stock, half bond portfolio to get my 8.5% historical return? I’ll do the math; I need to earn just over 15% per year. See below:

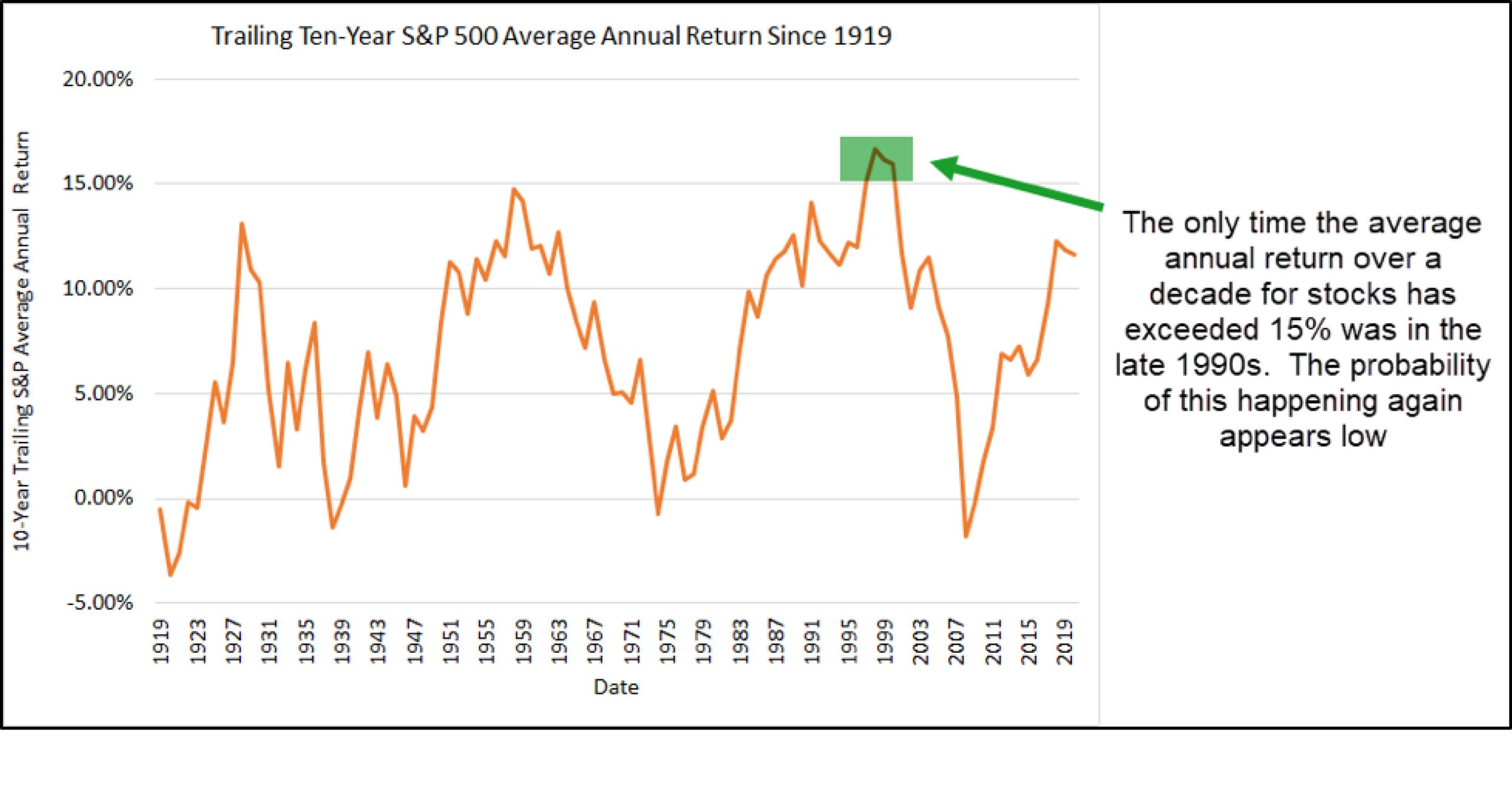

A 15% average annual return for stocks over ten years is unrealistic. In fact, there have only been four periods in the last 100 years where the average annual return over a decade has averaged over 15% – all in the late 1990s.

Here is what we believe returns will look like over the next ten years.

Stocks Will Only Return 7.25%!? Why Not 11%?

The answer has a lot to do with valuations. Starting from a trough in 2009, this is the longest economic expansion in modern history. Since then, stocks have gradually become relatively expensive through a variety of measures. One of these measures is called the price-to-earnings ratio. This ratio explains how much an investor is willing to pay for one dollar of earnings from stocks. It’s well above its historical average for stocks, which usually means that the prospects for further stock appreciation are diminishing.

Ironically, because of valuations, sometimes the fastest way for expected returns to increase is for the market to fall! Here’s an example. At the beginning of 2018, our forecasted average annual return for a diversified stock portfolio was only about 7% from 2018 to 2028. In 2019, just after the market fell nearly 20%, the expected return jumped to 12%. Now, in 2020, with the market back up and making all-time highs, our expected return is back down. In other words, all this complicated forecasting we are doing is simply encapsulating the idea of “buy low, sell high.”

So Are We Due For a Recession?

Potentially, but most of the typical warning signs of a recession have not presented themselves, so we believe the burden of proof is still on the pessimists. Here are a couple of things we will be watching throughout 2020:

- The Federal Reserve: The Federal Reserve cut interest rates AND flooded the market with dollars throughout the second half of 2019. This served as good fuel for the rocketing market through the year-end. If they reverse course this year and begin increasing rates again, it could put a dampener on the market rally.

- Manufacturing: Globally, the manufacturing sector has been faring poorly compared to the services sector. We are hoping the still relatively strong services sector will prop up the manufacturing sector rather than weakening demand for manufactured goods spilling over into the services sector.

- The Yield Curve: There was a yield curve inversion in March of last year. Historically, these inversions are good predictors of recessions, but their lead time can be over two years.

- The 2020 Election: Thus far, market movements seem to be hoping for a Trump vs. Biden or Trump vs. Sanders ticket. Based on the negative market reactions that follow when Elizabeth Warren makes a strong showing in debates, interviews, etc., the market is not very receptive thus far to a potential Warren presidency.

- The 2020 Census: Economic theory states that population growth is generally good – more taxpayers, more productive workers, more new ideas. The census will provide some clues of where the population is growing/shrinking and potentially where the next cities of innovation will be born.

- Tax Reform: We believe Trump will make a push to cut taxes, most likely targeting FICA or capital gains taxes, before the election. To wit, we also expect the US national debt to surpass $26 trillion in 2020, sending the US debt as a percentage of GDP to its highest level since the 1950s.

As mentioned before, we believe the market will be strong for at least the first half of 2020. Uncertainty regarding economic and political developments makes forecasting the second half of this year a much more difficult exercise. Regardless of what may be in store for the market, our disciplined investment process will be following the data day by day and will alert us to make portfolio adjustments should the risk of any major economic malaise materially increase.

We look forward to serving you and your financial needs for another year.

– Chris Diodato, CFA, CMT